MATIC, the native token of the Polygon ecosystem, surged 16.4% on October 4 with the launch of the Polygon 2.0 Goreli testnet. The asset failed to break the very strong resistance level of $0.60 and remained unchanged by October 10. It fell by 10.6 percent. This decline was exacerbated by the departure of Polygon’s co-founder and reduced activity on the network. MATIC price lost its upward momentum along with the gains it made in early October.

Rallies Follow Network And Protocol Updates

Polygon 2.0 is a network of ZK-based layer-2 chains joined through a new cross-chain coordination protocol. Polygon’s 2.0 scaling technology was introduced in June 2023 as a scaling ecosystem blueprint consisting of four layers: staking, execution, interoperability, and proof-of-concept. Each of these layers contributes to creating an interconnected chain ecosystem that facilitates secure, fast and extremely cost-effective transfers.

Benefits of Polygon 2.0 include improved security and privacy through ZK proofs, full compatibility with the Ethereum Virtual Machine (EVM), and cross-chain interactions. It is also worth remembering that the project continues to develop the ZK-STARK based layer-2 solution Miden. It could be argued that the recent decline of 10.16% represents a correction simply due to the over-excitement triggered by the launch of tesnet. However, there are other reasons for the negative opinions towards Polygon.

Polygon Loses Its Power As Competition Increases

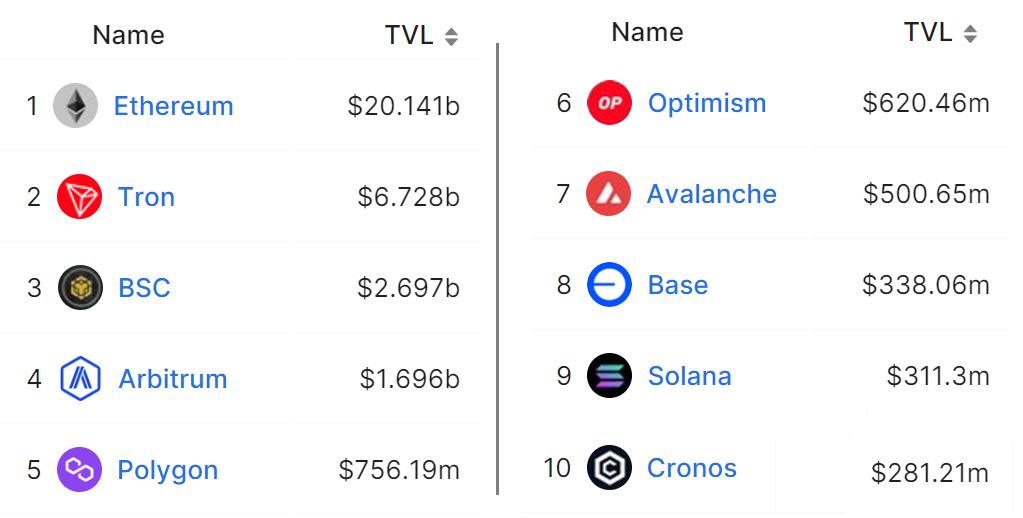

Measurements from on-chain data provider Artemis show a significant disparity between Polygon zkEVM’s 6,210 active addresses, StarkNet’s 154,390, and zkSync ERA’s 239,810 active addresses. A similar inconsistency is evident when considering the number of daily transactions. Polygon’s zk-rollup outperforms its competitors. Total value locked (TVL) at Polygon stands at $756 million. This is less than half of Arbitrum’s layer-2 solution.

Although Polygon launched earlier than most Ethereum layer-2 solutions in June 2020, it faces competition from Optimisim and Base. Polygon co-founder Jaynti Kanani’s announcement that he was leaving the project on October 4 caused discomfort for investors. Along with the decline in MATIC’s performance, there has also been a decline in the usage of the Polygon network’s dApps. On average, the number of top dApp active addresses on the Polygon network has dropped by 17% over the last 30 days. While this issue particularly concerns the NFT and DeFi markets, it particularly affects applications such as Uniswap, OpenSea and Move Stake. Although the Polygon team is constantly introducing new updates and improvements to the network, news continues to drop that the fix is normal.